Getting Started: Organization Profile

This article provides an overview of the Organization Profile in your Double the Donation Matching module and the information we encourage organizations to provide to take advantage of matching gift auto-submission.

Your Organization's Information

Sharing with Open Discovery Platform Partners

Overview of the Organization Profile

The Organization Profile is where you input key details about your nonprofit organization. This information ensures that Double the Donation has the correct data to manage and track matching gift submissions for your organization. By providing complete and accurate details, you can streamline the process for both your donors and your team.

Your Organization's Information

In this section, you will input the fundamental details about your nonprofit. This information is necessary for Double the Donation to process matching gift requests and ensure smooth communication.

Required Fields:

- Organization Name

This is the official name of your nonprofit organization as registered with the IRS or relevant governing body. - Phone Number

The primary phone number for your organization. - Department Name:

This refers to the specific department (e.g., Workplace Giving, Fundraising Team) responsible for managing matching gifts within your organization - General Email Address:

A general email address where your nonprofit can receive inquiries and notifications about matching gifts. This could be the email for your matching gift program or a dedicated inbox for donor communications. - Website URL:

Your organization's website address (including https://). This provides a public-facing link to your nonprofit’s website, helping CSR platforms and donors confirm your legitimacy and learn more about your cause. - Country of Taxation:

This field specifies the country where your organization is registered for tax purposes. It’s becessary as it determines your organization’s tax status (e.g., nonprofit, charity, or exempt status) and affects where matching gifts are processed.

For example, U.S. nonprofits would select the United States, while Canadian organizations would select Canada. - Tax ID:

Your organization’s Employer Identification Number (EIN) or Tax Identification Number (TIN) issued by the IRS (for U.S. organizations) or the relevant tax authority in your country. This unique identifier ensures that your organization is recognized for tax-exempt purposes and is essential for processing matching gifts.

Your Organization's Address

Provide the full mailing address for your organization to ensure correct communication and verification.

Required Fields:

-

Address Line 1

-

Address Line 2 (optional)

-

City

-

State/Province

-

Zip/Postal Code

Your Organization's Documents

To verify your nonprofit status and streamline the matching gift process, upload key documents such as your W-9 and IRS letter of attestation.

Recommended Documents:

-

W-9 Form

-

IRS Letter of Attestation (Tax-Exempt Status)

Matching Gift Auto-Submission

Enabling the auto-submission feature ensures that donors’ matching gift requests are automatically submitted to the relevant company. This reduces manual effort and helps process more matches efficiently.

How to Enable Auto-Submission:

-

Toggle the "Matching Gift Auto-submission" option to enabled.

-

Donors whose gifts are auto-submitted will receive a simple, automatically generated confirmation email.

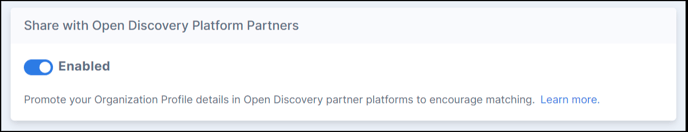

Sharing with Open Discovery Platform Partners

You can promote your Organization Profile details through Open Discovery platform partners to encourage more matching. This helps increase visibility and matching gift opportunities from employees of companies participating in the Open Discovery Program.

How to Enable Open Discovery Sharing:

-

Toggle the "Share with Open Discovery Platform Partners" to enabled to allow your organization’s details to be shared.

FAQs:

Q: Why should we list our organization's Tax ID or EIN Number?

A: The Tax ID (EIN) is essential for verifying your nonprofit’s eligibility for matching gifts. Listing it ensures smooth processing and accurate tracking of matches. Learn more about why you should list your Tax ID.

Q: What if I don't know our organization's Tax ID or EIN Number?

A: To find your organization’s Tax ID or EIN, use the Tax Exempt Organization Search page on the IRS website.

Q: Where is the information in our Organization Profile used?

A: The details in your Organization Profile are used to complete auto-submission flows for matching gifts. It also helps Double the Donation maintain up-to-date records for your organization.

Q: Why should we upload our documents?

A: Many companies require documentation to process matching gift requests. By uploading frequently requested documents (such as your W-9 and IRS letter), when your donors complete the auto submission flow, you enable Double the Donation to automatically send these documents to the company processing the matching gift request. This reduces delays and ensures your matching gift process is not halted due to missing paperwork.